Recently, the Bank of Zambia working in conjunction with the Ministry of Finance and National Planning and the Ministry of Small and Medium Enterprise Development, produced a report titled "2022 Micro Small and Medium Enterprise Finance Survey Report" where the following problems were identified on page 32 of the said report as the top three problems out of a total of fifteen problems faced or experienced by many Micro, Small and Medium Enterprises (MSMEs) in Zambia namely high bank lending interest rates, lack of collateral or no security and low income levels or turnover.

So, today I thought of sharing my thoughts on how to turn these top three problems of high bank lending interest rates, lack of collateral or no security, low income levels or turnover including drought as a problem into business opportunities.

Therefore, how do you turn these economic problems into business opportunities? Well, may be the following suggested strategies could be of help to someone out there:

1. High Bank Lending Interest Rates:

For instance, if you need some insider ideas on how to apply this particular strategy to real estate investment in order to help you increase your investment portfolio, then see and read this blog post by clicking>>HERE for inspiration!!!

You'll Be Happy You Did Read The Above Recommended Blog Post!!!!!

(b) Establishing a microfinance business or becoming a private money lender who offers affordable and flexible loans to individuals and MSME's at lower interest rates than conventional banks can equally be a very good business idea for investors with extra cash lying idle in their savings or Investment accounts. Earning profit on your money is much more rewarding and highly progressive than earning a meager interest rate given to you by the various banks or investment firms where you are saving your money.

(c) Developing financial literacy products and services (whether digital or physical ones) that educate individuals and owners of businesses on how to generate revenue, increase income and manage finances effectively and teaching or showing them how to access alternative sources of funding can help someone out there become an info-preneur than folding one's arms and saying there are no jobs!

2. Lack of Collateral:

(b) Partnering with organizations that provide credit guarantees or insurance to mitigate the risk associated with lending to individuals or businesses without collateral may also be another good business opportunity idea.

(c) Focusing on building relationships and trust with borrowers to assess creditworthiness based on factors beyond collateral. Talk about leveraging your current network for profit!!!

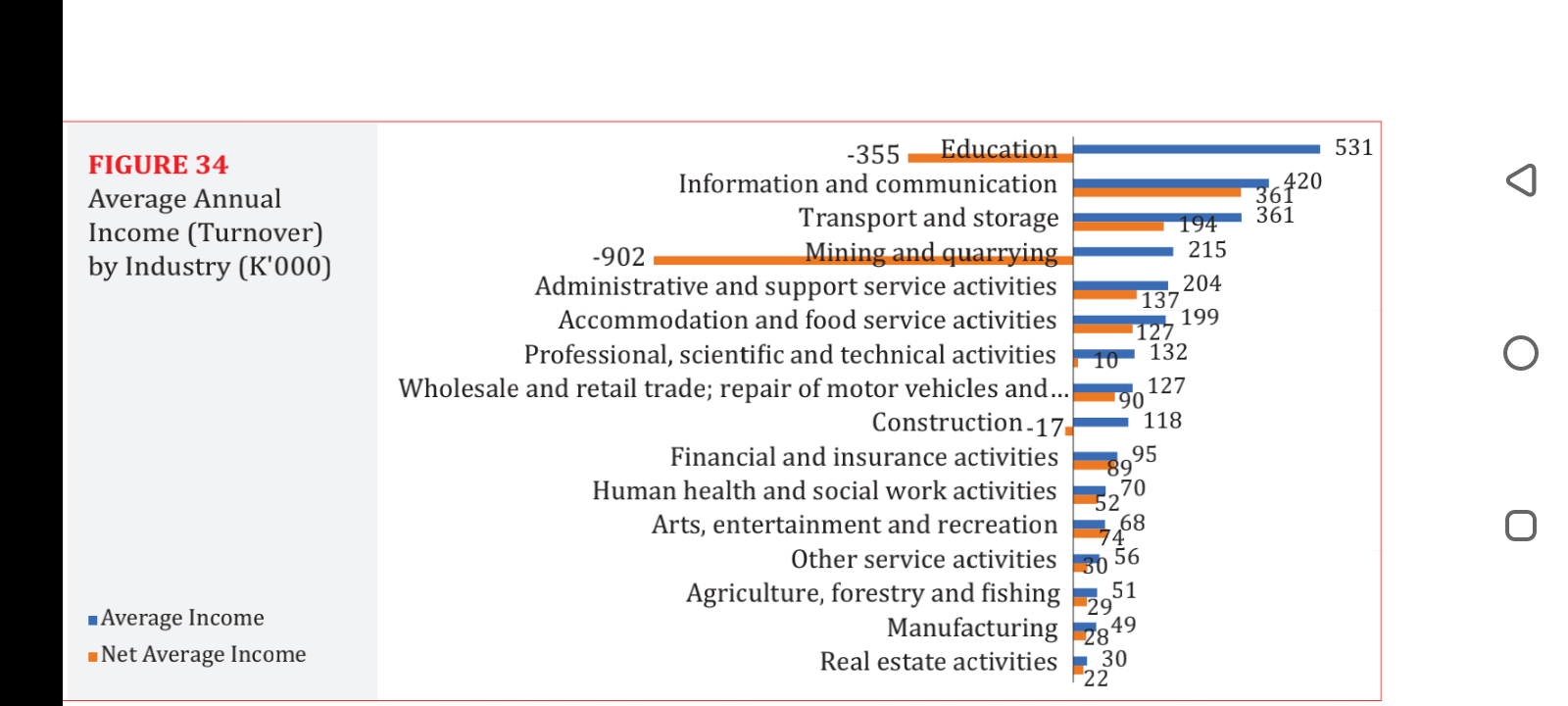

3. Low Income Levels or Turnover:

(b) Helping Individuals or MSMEs business owners with their sales and marketing efforts in order to help them grow and increase their sales and eventually their revenue base can prove to be a very lucrative business opportunity for any person who is good at this art!!!

(c) Establishing community-based cooperatives or social enterprises that pool resources and provide shared economic benefits to low-income individuals including MSMEs.

(d) Offering flexible payment terms and tailor-made financial products that cater to the cash flow challenges faced by individuals or MSMEs with low incomes.

4. Drought:

For instance, the Government of the Republic of Zambia through the 5th Cabinet Meeting held on Monday 18th of March, 2024 issued a Circular or Press Release Document where Cabinet approved the issuance of a Statutory Instrument namely the Customs and Exercise (Suspension) (Wheat) Regulations, 2024, which provides for the suspension of duty on the importation of 100,000 metric tonnes of wheat. This measure was necessitated due to the fact that the Government foresees a deficit of wheat during the year of 2024 and possibly beyond. This measure according to the Government, is necessary in order to allow local millers to meet the shortfall in the supply of wheat on the local market and allow millers to continue production in the face of low supply of the commodity.

Therefore, the above presents a farming business opportunity to engage in wheat farming as well as other crops such as maize on a massive scale in order to meet domestic and eventually international demand!!!

Note: Looking for an already developed farm or semi-developed farm to start farming right away?

Well, Get in touch for Details using either the comment box below or WhatsApp: +260 955 168754 and we should be able to provide you with the necessary information regarding available farms on sale, recommended good and/or suitable areas in Zambia where you can do your farming activities right now, information on how to qualify for tax exemption incentives including any other important information you may need to know to help you make a proper and informed decision on farming opportunities in the Republic of Zambia!!!

(b) Diversifying and/or engaging into drought-resistant agriculture or livestock farming practices that are less susceptible to water scarcity.

Examples of drought resistant agriculture include cultivating and growing the following:

Drought-Tolerant Crops:

(i) Sorghum: Sorghum is a versatile cereal crop that is highly drought-tolerant. It has deep roots that help it access water from lower soil layers, making it resilient during dry spells.

(ii) Millet: Millet is another drought-resistant cereal crop that thrives in hot and dry conditions. It requires less water compared to other grains like rice or wheat.

(iii) Cassava: Cassava is also an excellent drought-resistant crop, important for food security, and presents many opportunities for producers or farmers through value addition. Although different varieties of cassava are ready for harvest in 8 to 12 months while maize takes around four months, in the long run, cassava farmers have more to eat and supply than maize farmers, who harvest sooner. Why? Because cassava, unlike maize, is highly drought tolerant and can grow in semi-arid areas with little rain to no rain at all.

Legumes:

(i) Chickpeas: Chickpeas are legumes known for their drought tolerance. They have deep root systems that enable them to access moisture from deeper soil layers, reducing their dependence on frequent watering.

(ii)Lentils: Lentils are another legume crop that can withstand dry conditions. They have a short growing season and do not require excessive irrigation.

Root Vegetables:

(i)Sweet Potatoes: Sweet potatoes are root vegetables that are relatively drought-resistant. They can continue growing even with irregular watering, making them suitable for arid regions.

(ii) Carrots: Carrots have taproots that penetrate deep into the soil, allowing them to access water stored at lower levels during drought periods.

Perennial Crops:

(i) Almonds: Almond trees are perennial crops that have adapted to Mediterranean climates with limited water availability. They can survive with less irrigation once established.

(ii) Olives: Olive trees are well-suited to arid conditions and can thrive with minimal water inputs once they reach maturity.

By incorporating these drought-resistant crops into farming practices, farmers can mitigate the impact of water scarcity and maintain agricultural productivity even in challenging environmental conditions.

And examples of Livestock Farming include the following:

(i) Cattle Farming: Cattle farming involves raising cattle for various purposes such as beef production, dairy farming, and as draft animals. Different breeds of cattle are raised depending on the specific purpose, with breeds like Hereford, Shorthorn, Angus, Holstein-Friesian, and Jersey being prominent in beef and dairy production.

(ii) Chicken Rearing and Egg Production Farming: Chicken rearing and egg production farming involve the raising of chickens primarily for meat and eggs. In this process, chickens are bred, fed, housed, and managed to ensure optimal growth, health, and productivity for both meat and egg production. In other words, chicken rearing involves breeding, feeding, and managing chickens for meat production, while egg production farming focuses on optimizing conditions for hens to lay plenty eggs efficiently for profit maximization.

(iii) Sheep Farming: Sheep farming is the practice of raising sheep primarily for their wool, meat (mutton and lamb), and milk. There are around 200 recognized breeds of sheep worldwide, each suited for different purposes such as wool production or meat.

(iv) Pig Farming: Pig farming, also known as swine farming, focuses on raising pigs for their meat (pork). There are over 300 pig breeds globally, with different types classified based on their intended use such as lard, bacon, or pork production.

(v) Goat Farming: Goat farming involves raising goats for various products including milk, meat, hides, and wool.

(vi) Horse Farming: Horse farming includes breeding horses for various purposes such as farm work, riding, show competitions, and racing.

(vii) Donkey and Mule Farming: Donkeys (asses) and mules are used as work animals on farms due to their strength and sure-footedness. Donkeys are also employed as saddle mounts. Mules are hybrids resulting from crossbreeding a male donkey with a female horse.

The above examples showcase the diverse practices involved in livestock farming across different animal species for various agricultural purposes.

(c) Providing water management business solutions such as rainwater harvesting systems in times of plenty rain, offering drip irrigation technologies or solutions, or water conservation solutions that help individual farmers harness this resource for farming is a good way to turn the problem of drought into a viable business opportunity for any shrewd investor!

(d) Offering insurance products or services specifically designed for farmers affected by drought to protect their livelihoods during periods of crop failure is also a good way to turn the problem of drought into a viable business opportunity for some investors!

By addressing these economic problems creatively and strategically, you can transform them into viable business opportunities that not only generate income but also contribute positively to the community’s resilience, job creation and economic development in general.

About The Author

Therefore, Call/WhatsApp/Sms him right now on +260 966 388525 and contact him for one on one real estate investment advice or legal advice!

He also stands ready to be booked for speaking engagements as well as offer free and paid radio and television interviews with any individual or organization interested in him sharing his deep insight and understanding of real estate matters as well as offer legal advice pertaining to land rights and ownership in the Zambian Market Landscape!!!!